Zurich Futura Critical Illness List – Updated 2026

One major illness can disrupt your income, but one payout can secure your financial future and dignity.

Zurich Futura’s Critical Illness Benefit is designed to do exactly that; offer a financial lifeline when life takes an unexpected turn.

If you are looking for the most comprehensive protection guide, this post provides;

Table of Contents

What Critical Illness Cover Actually Does

Critical Illness Cover pays you, not the hospital.

You can use the payout at your discretion to cover;

- Treatment gaps & recovery costs

- Rent/mortgage & school fees

- Daily living expenses

- Loan EMIs

- Early retirement if needed

- Income replacement during recovery

Medical Insurance = Pays the hospitals and doctors

Critical Illness Cover = Pays you.

If you rely on your income, this is not optional. Even with no dependents, losing 12–36 months of earnings can destroy your finances.

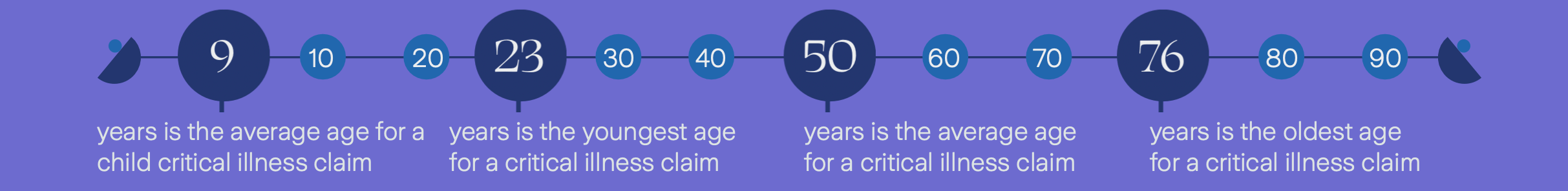

Zurich’s latest claims report (2025) shows:

- Youngest CI claimant: 19

- Average age: 49

- Top claims: Cancer + Heart Disease

CI cover is not just for old age, it is to protect against loss of income during your prime earning years.

It’s a financial safety net — giving you breathing space when your health takes a hit.

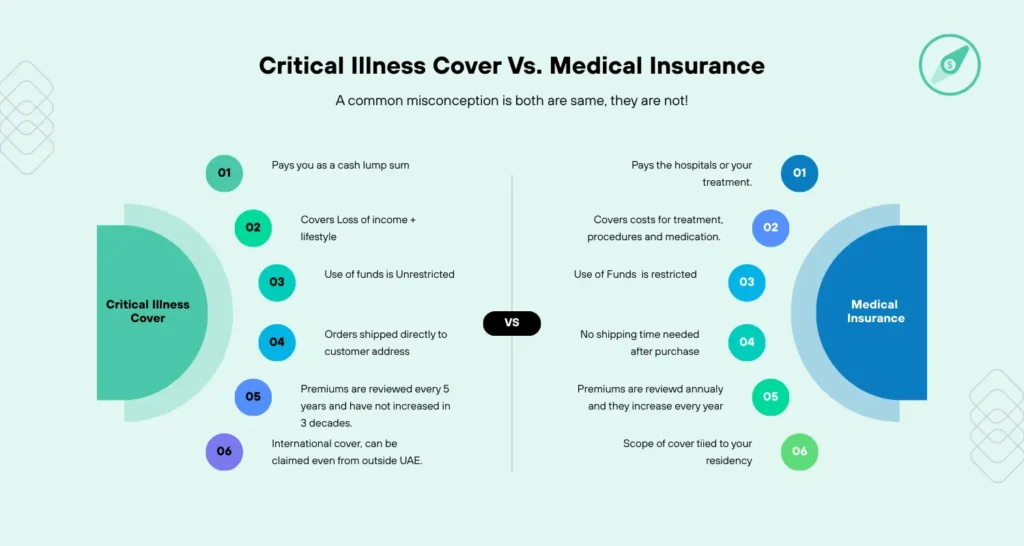

Critical Illness Cover vs. Medical Insurance

A common misconception is that medical insurance is enough. It isn’t.

Medical Insurance pays for your treatment; hospital bills, surgeries, doctor visits, and medications.

But what about the rest?

💸 Rent or mortgage

🍽️ Groceries

🎓 School fees

🧾 EMIs and daily expenses

These don’t stop, even if you can’t work!

That’s where Critical Illness Cover comes in:

While Medical Insurance pays the hospital, Critical Illness Cover pays you — to spend however you need

Use it to:

- Replace lost income

- Support your family

- Focus on recovery

- Keep life moving

| Category | Medical Insurance | Critical Illness Cover |

|---|---|---|

| Pays | Hospitals & doctors | You (tax-free lump sum) |

| Covers | Treatment costs | Loss of income + lifestyle |

| Use of funds | Restricted | Unrestricted |

| Continues paying bills? | ❌ No | ✅ Yes |

| Replaces salary? | ❌ No | ✅ Yes |

Medical insurance keeps you alive. Critical Illness Cover keeps your life affordable. Both matter, for different reasons.

What claimants Say? – Real World Insights – Reddit thread

Critical Illness Cover is perhaps the most valuable rider you can add to Zurich Futura, or any life insurance plan.

With modern medicine, people are increasingly surviving major health conditions that once meant certain death. But survival is only one part of the story.

Recovery can take months, sometimes years, and during that time, many are unable to earn an income.

One of my clients, a C-suite executive, was diagnosed with Advanced Coronary Artery Disease (CAD) and underwent a triple bypass surgery.

The good news? They survived.

The bad news?

Their body could no longer handle the demands of a high-stress corporate role. They were forced to retire a decade earlier than planned.

Fortunately, they had taken the right steps early — with $2,000,000 of Critical Illness Cover and a well-diversified portfolio across real estate, retirement plans, and investments.

That one payout changed everything. It gave them the freedom to recover, retire early, and maintain their lifestyle without financial stress.

Now imagine if they didn’t have that cover.

No income. Mounting medical expenses. And years of financial uncertainty ahead.

That’s the kind of risk Zurich Futura’s Critical Illness Benefit is designed to eliminate.

What real claimants say

Before you decide whether Critical Illness cover is “worth it”, read real experiences from people who lived through long recoveries — and from families who saw what happens when income stops. It’s cheaper to learn from others than to learn the hard way.

- “Hospital bills were covered — but we needed cash for life.” CI helped replace income and pay everyday commitments.

- “The payout bought time.” Recovery without panic-selling investments or rushing back to work.

- “I never thought it would happen at my age.” Claims often occur during prime working years.

Zurich Futura Critical Illness List (Updated 2026)

The Zurich Futura Critical Illness Benefit currently covers the following conditions:

Organ & Cancer-Related

- Cancer (excluding less advanced cases)

- Ductal carcinoma in situ (DCIS) – partial payment

- Major organ transplant •

- Liver failure – end stage

- Kidney failure – requiring dialysis

- Primary pulmonary arterial hypertension – permanent

Heart & Circulatory System

- Heart attack – specified severity

- Heart failure

- Coronary artery by-pass grafts – with sternotomy

- Heart valve replacement/repair – with sternotomy

- Cardiomyopathy

- Aorta graft surgery – disease/trauma

Brain & Neurological

- Stroke – with permanent symptoms

- Multiple sclerosis – with persisting symptoms

- Motor neurone disease – permanent

- Parkinson’s disease (before 65) – permanent

- Dementia including Alzheimer’s (before 65)

- Benign brain tumour – permanent symptoms

- Encephalitis

- Traumatic head injury – permanent symptoms

- Creutzfeldt-Jakob disease – continuous assistance

- Coma – permanent symptoms

Senses & Functions

- Blindness – permanent and irreversible

- Deafness – permanent and irreversible

- Loss of speech – permanent and irreversible

- Loss of independent existence – permanent

- Loss of hands or feet – permanent severance

- Paralysis of limbs – permanent

Immune & Blood

- Systemic lupus erythematosus – specified severity

- Aplastic anaemia – permanent symptoms

Lung & Respiratory

- End-stage lung disease / respiratory failure

Infections & Other Conditions

- Bacterial meningitis – permanent symptoms

- HIV infection* – transfusion/assault/occupational

Child-Specific Benefit

- Children’s critical illness benefit

Severe Trauma

- Third-degree burns (20% body or 50% face)

*Certain illnesses require diagnosis/treatment in eligible countries. Refer to policy wording for definitions and country list.

Key point: Cancer and cardiovascular illnesses make up ~90% of paid CI claims, not exotic diseases. This matches real-world UAE risk profiles.

Zurich Futura CI Benefit – Key Technical Details

1. Eligibility

- Entry age: 18–64

- Coverage duration: up to age 95 for most conditions

2. Deferment Period

- 90-day waiting period from policy start or benefit commencement

- Diagnosis during deferment = no claim

3. Maximum Sum Assured

- Lower of:

- USD 2,000,000, or

- Selected life cover amount

You cannot insure more CI than life cover.

4. Inclusive (Not Additional)

CI payout reduces life cover.

Example:

Life Cover: USD 500,000

CI Payout: USD 400,000

Remaining Life Cover: USD 100,000

Zurich Critical Illness Claim Statistics (Middle East 2025)

From Zurich ME Claims Report (2022–2024):

- USD 241 million total claims paid (3 years)

- 98% of life claims approved

- 51% of CI claims: Cancer

- 41% of CI claims: Heart attack & stroke

- Average age: 50

- Youngest claimant: 19

Translation: These are common, claimable, working-age risks, not fringe scenarios.

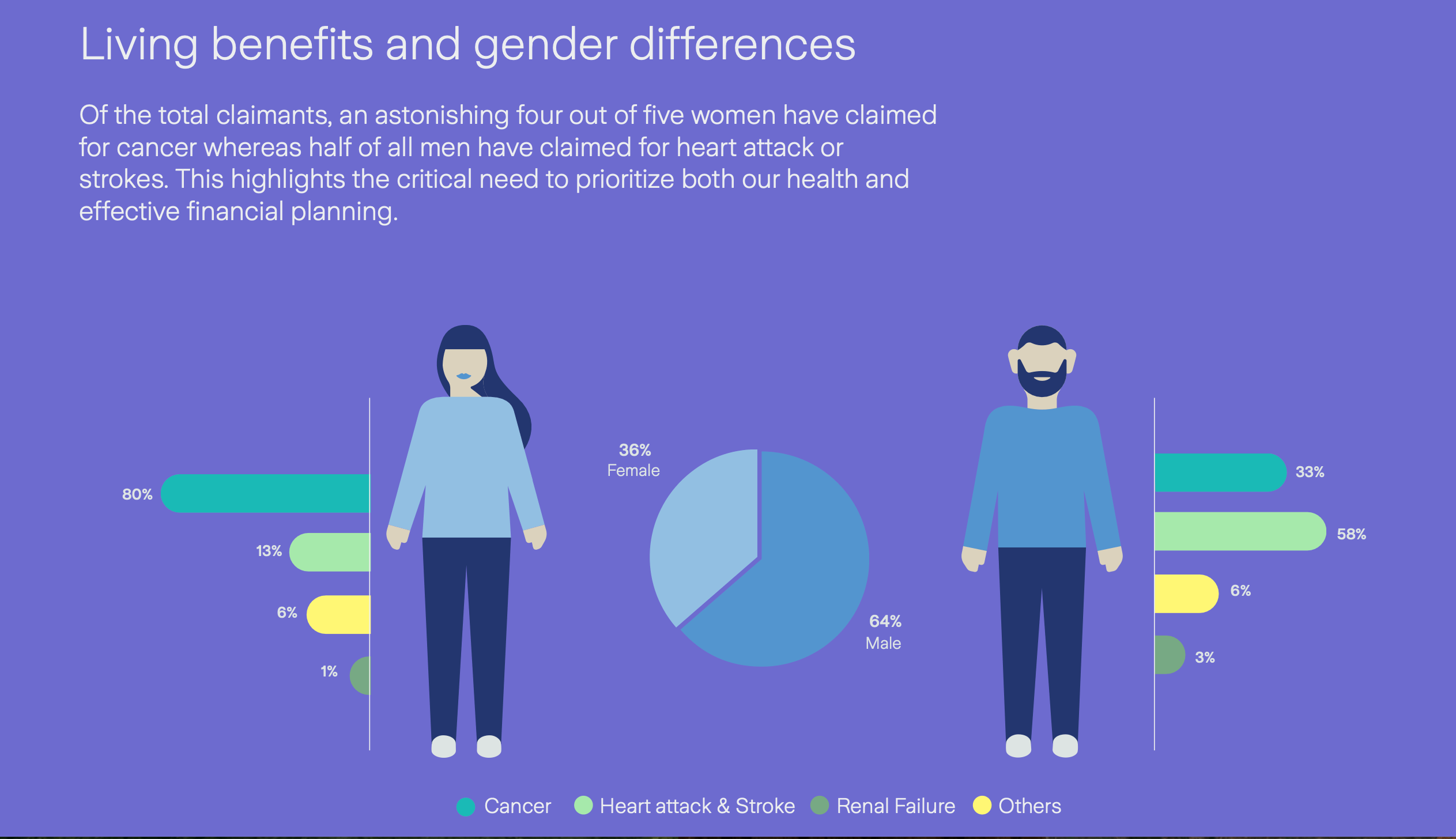

4 out of 5 female CI claimants claiming for cancer, and 1 in 2 men claiming for heart-related illnesses. This shows how common and claimable these risks truly are. – Source – Claims report 2025

What If You’re Not Eligible for Full CI?

Zurich offers Cancer Cover as an alternative.

It pays a lump sum on:

- Cancer diagnosis

- Specific procedures (depending on type)

It still reduces life cover (inclusive benefit) and still protects income during treatment.

Zurich Futura CI List PDF

If you’re searching for the Zurich Critical Illness List PDF, note:

- The list is part of the policy terms & conditions

- You get it after underwriting

- Public PDF versions may be outdated online

If needed, request a current copy and I’ll send the updated 2025 PDF directly.

Who Should Care About This Benefit?

Critical Illness Cover is most relevant for:

✔ High-income professionals

✔ Business owners

✔ Single earners / breadwinners

✔ Parents with school fees

✔ Individuals with loans/mortgages

✔ UAE residents without disability income protection

If your income pays the bills, CI cover protects your lifestyle and time.

Final Word

Most people underestimate CI risk because they think survival = success.

But survival without income is financial ruin.

If you’re working, borrowing, raising kids, or supporting anyone financially, Critical Illness Cover is not optional.

If you want to:

✔ Protect income

✔ Protect lifestyle

✔ Avoid forced early retirement

✔ Avoid debt after a diagnosis

✔ Get claims from a reputable insurer in the UAE

Zurich Futura CI is one of the strongest options.

Ready to Secure your Financial Future?

You insure your car. You insure your home. Isn’t it time you insured your ability to earn?

Your health is your most valuable asset, and Critical Illness Cover ensures that a major illness diagnosis doesn’t derail your life plans.

✅ Protect your income, your lifestyle, and your peace of mind

✅ Take action while you’re healthy and eligible

✅ Gain confidence that you’re prepared. No matter what life throws at you

Click here to book a Discovery Call

Let’s build a protection plan that stands strong, so you can focus on living fully.