Financial Planning in Dubai

Most people believe they have a financial plan.

They don’t.

What they actually have is a series of financial decisions, or the absence of them, made on the go. Savings, investments, property, and even insurance may exist.

But without structure, they pull in different directions. Competing instead of compounding.

Why This Happens?

What Real Financial Planning Actually Looks Like

Financial planning is not about making more decisions.

It’s about designing a structure that holds every decision together.

A real plan does three things:

The GAiM Plan

A one-page financial plan built for UAE residents.

- It starts with where you are.

- Clarifies where you want to be in 10, 15, and 20 years.

- And aligns your income, savings, and investments in the UAE toward that direction.

The result is simplicity, progress and control.

- One structure.

- Clear sequencing.

- Deliberate decisions.

When your plans and actions are aligned, clarity replaces noise and progress stops being accidental.

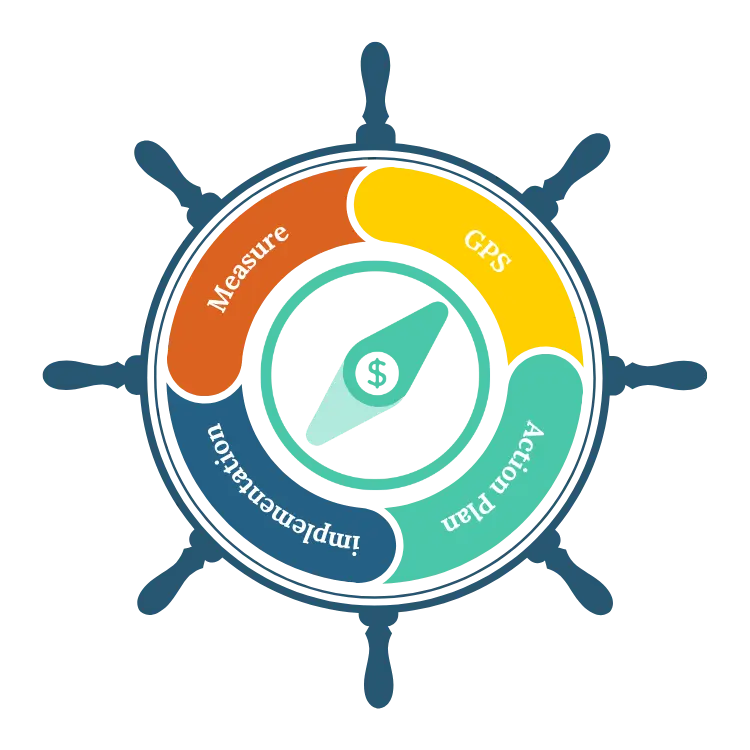

GAiM Plan: From Intent to Execution and Achievement

GPS — Goal Positioning System

A GPS works with two coordinates:

your current position and your destination.

The GAiM Plan applies the same logic.

Where you are today.

Where you want to go.

By when.

Without all three, direction is guesswork

Action Plan

Once direction is clear, we define the steps.

What to do.

What comes first — and next.

What waits — and what gets cut.

Every action is chosen by how it strengthens the whole plan, not in isolation.

Implementation

Plans only matter if they’re executed properly.

This stage is about disciplined implementation:

Putting the right solutions in place — in the right order

Aligning existing assets to the plan and its priorities

Blocking rushed, reactive, or emotional decisions

No FOMO. No fear. Just deliberate execution.

Measurement & Progress Tracking

Progress is reviewed, not assumed.

We track

Movement toward goals

Changes in income, expenses, and risks

Whether the plan still reflects reality

This is what keeps the system relevant as life changes.

What Happens in a GAiM Plan Sessions

In the GAiM Plan session, we:

You leave with a one-page GAiM Plan and clear direction.

No rushed decisions

Who This Is For — And Who It Isn’t

|

Pros

|

Cons

|

|---|---|

Start with a GAiM Plan Session

Bring structure, clarity, and direction to your finances.