SIP in UAE: The best way to Build Wealth?

For most people, wealth doesn’t begin with a large lump sum.

It begins with income, earned through salaries, profits, or bonuses. Converting that income consistently into long-term wealth requires a system.

This is where a SIP in UAE fits naturally.

A SIP creates a simple, repeatable system that moves money from your bank account into investments every month. No timing decisions. No emotional calls. Just steady conversion from surplus income into invested capital.

And when done right, that consistency matters more than cleverness.

What Is a SIP?

SIP stands for Systematic Investment Plan.

It’s not a product.

It’s a method.

A SIP allows you to invest a fixed amount at regular interval, typically monthly; into investments such as mutual funds, ETFs, or managed portfolios.

This is why people often get confused about the difference between SIP and mutual fund:

- A mutual fund is the investment vehicle.

- A SIP is simply the way you invest into it.

You can invest in mutual funds through SIPs, lump sums, or a combination of both. Understanding this distinction helps set realistic expectations from the beginning.

Why SIP in UAE Make Sense?

Life in the UAE is dynamic. Careers evolve, income changes, and long-term residency isn’t always predictable. Investing needs to adapt to that reality.

A SIP investment in the UAE works well because it aligns with how people actually earn and save.

A monthly investment plan allows you to:

- Start with manageable amounts

- Increase contributions as income grows

- Stay invested without waiting for the “right time”

For many residents, this ends up being the most practical way to invest, especially compared to letting surplus income sit idle or get absorbed into lifestyle upgrades.

How SIPs Help Manage Market Ups and Downs

Markets don’t move in straight lines. And most people struggle with timing.

SIPs remove that pressure.

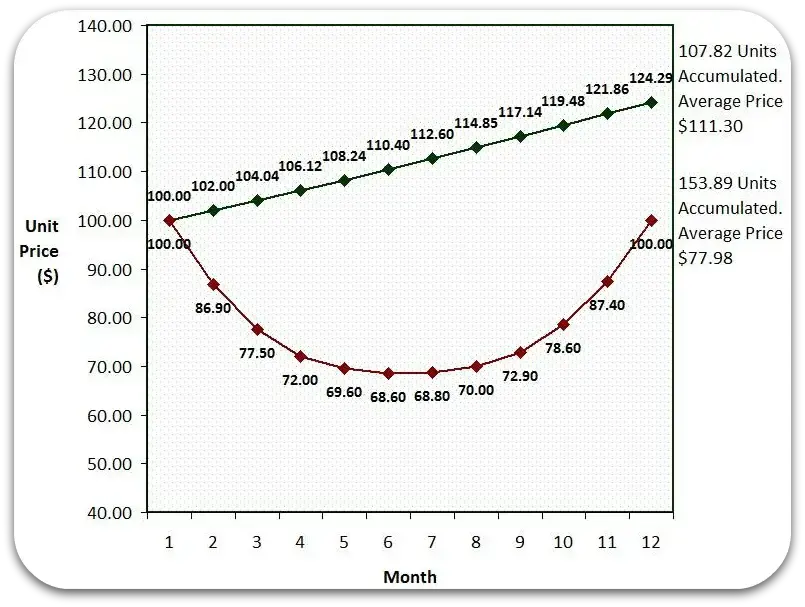

By investing a fixed amount regularly:

- You buy more units when markets are down

- You buy fewer units when markets are up

Over time, this naturally averages out your purchase cost and reduces the emotional stress that often leads to poor decisions. – Dollar cost Averaging.

You’re not trying to predict markets.

You’re building a habit.

The Role of Compounding

Compounding is powerful, but it tests patience.

In the early years, progress feels slow. This is where many investors lose confidence or stop altogether. Yet most of the real growth happens later, when returns start compounding on previous gains.

The biggest risk to SIP Plans and compounding is not volatility. It’s interruption.

Consistency matters far more than short-term performance.

👉 Use the SIP Investment Calculator to understand how regular investing can compound over time.

Income Phase vs Capital Phase: A Critical Distinction

This is an important point that often gets overlooked.

SIPs are most effective when you’re investing from income.

At this stage, the priority is discipline; creating a reliable system that converts earnings into invested capital over time.

Once you’ve already built a meaningful lump sum, the equation changes.

With existing capital, your options expand:

- phased deployment

- valuation-driven investing

- asset allocation and rebalancing

- income or capital-preservation strategies

At that stage, SIPs may still play a role, but they’re no longer the main engine. Capital allocation becomes the dominant decision, not just the monthly contribution discipline.

Understanding which phase you’re in avoids unrealistic expectations and poor strategy choices.

SIP vs Lump Sum: A Practical View

Both approaches have their place.

Lump-sum investing can work well when valuations are attractive and emotions are under control. SIPs, on the other hand, suit regular income earners who value structure and consistency.

For most people investing in the UAE, SIPs feel more sustainable, not because they promise higher returns, but because they’re easier to stick with over time.

How to Invest in SIP Plans in the UAE?

In the UAE, SIPs or regular investment plans can be set up through multiple routes, depending on your goals and preferred level of control.

Some investors use established insurers such as Zurich, MetLife, Salama, Sukoon, or NGI, where SIPs are offered within structured long-term investment plans.

Others prefer platforms like Interactive Brokers or Ardan, which provide direct access to global markets and greater flexibility in fund selection.

NRIs also have the option to invest in Indian mutual funds, either in INR or USD, based on their goals, currency preference, and future residency plans.

Each route differs in terms of costs, liquidity, and flexibility, making the choice of structure as important as the investment itself.

Final Thought

A SIP is not about getting rich quickly or beating the market.

It’s about building wealth quietly and consistently.

A SIP works best when it’s not set up in isolation, but as part of a clear financial plan.

The real value comes from aligning your monthly investments with your goals, time horizon, risk tolerance, and life stage, so your SIP doesn’t just run, but actually takes you where you want to go.

If you’re looking for help setting up a SIP within a structured financial planning framework, I can help you bring clarity around:

- how much to invest

- where to invest

- how long to stay invested

- and how the SIP fits into your broader wealth plan

Let’s build a SIP and financial plan that’s designed for your real life, not assumptions or market noise.👉 Use the SIP Investment Calculator to understand how regular investing can compound over time.