How to Invest in the Stock Market: 5 Steps to Smart Investing.

You hear stories of people making 20%, 30%, sometimes even doubling their money in a short period.

They make it sound effortless.

“I bought at the right time.”

“The opportunity was obvious.”

“You should have done it too.”

Suddenly, investing feels easy.

At the same time, you also hear the opposite.

People who entered with confidence… and exited with regret.

- Savings cut in half or totally vanished

- Plans delayed.

- Lessons learned the hard way.

So which story is true?

The success everyone brags about

or

the losses people regretfully admit.

This confusion leaves most beginners wondering “how to invest in the stock market the right way?”

- They keep reading.

- They keep waiting.

- They hope for certainty before they act.

Then they search online and find statements like this:

“Since 1926, the S&P 500 has delivered close to 10% per year on average, including dividends.”

Sounds reassuring.

But it also raises new questions.

If markets grow like that,

- why do so many investors still struggle?

- Why do some succeed while others quit?

- What separates progress from disappointment?

So let’s answer the real question clearly:

How to Invest in the Stock Market (Beginner’s guide to investing)

No jargon. No hype.

Just principles that work in the real world.

Step 1 – Start With a Goal, Not a Stock

Before choosing any investment, answer one simple question:

What is this money for?

- Retirement?

- Children’s education?

- Property?

- Financial freedom?

Because your goal immediately determines;

• how much risk you can take

• how long you must stay invested

• what return you actually need

No goal and no timeline leads to only one outcome:

Directionless investing!

This is exactly why every investor I work with begins by building clarity through the GAiM Plan.

Instead of chasing products, we first map:

✔ where you are today

✔ where you want to be

✔ how much time you have

✔ how to use your available resources efficiently

✔ which goals should come first

✔ how much should be allocated to each goal

Only then do investments enter the conversation.

Because strategy should follow direction, not excitement.

Step 2 – Know the Risk You Can Survive

Notice the word survive, not prefer.

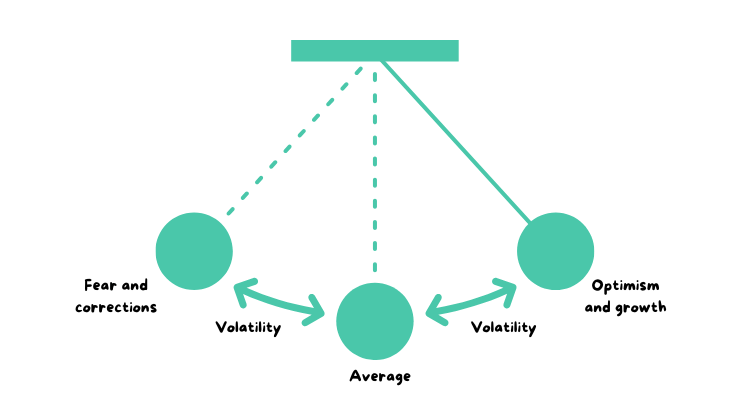

You may hear markets have delivered 8–10% per year over long periods.

But averages hide downturns in plain sight.

One year could be +25%.

Another could be -30%.

And if you are learning how to invest in the stock market after watching prices rise in recent years, it is easy to assume growth is linear.

It isn’t.

Markets test investors regularly, often without warning.

History has shown this repeatedly, whether during the early-2000s decline or other major corrections.

Confidence is built in rising markets, and Wealth is built or lost in falling ones.

So the real question is not:

“What return will I get?”

It is:

“How much risk and volatility can I survive?”

Step 3 – Build Allocation Before Choosing Investments

Beginners often jump straight to picking stocks or funds

Wrong move.

First decide:

• how much goes into growth

• how much into stability

• how much must remain accessible

Then comes the layer many investors ignore:

Diversification.

Within growth, you typically spread exposure across:

• countries

• sectors

• investment styles

Because even strong ideas go through bad phases.

How to Invest in the Stock Market in UAE – Local vs Global Exposure

Like everything UAE offers a choice of investments from all over the world.

Stocks from local exchanges like Dubai financial market or Abu Dhabi Securities Exchange (ADX) can provide familiarity, dividend culture, and exposure to regional growth.

However, they may be concentrated in fewer industries.

Global markets like United States, India, or United Kingdom offer broader diversification, global innovation, and deeper liquidity.

But they introduce currency and international economic influences.

What Experienced UAE Investors Typically Do

Rather than choose one, they combine exposures.

They build global diversification while maintaining selective regional participation.

This approach reduces dependence on a single economy and improves resilience across market cycles.

Why This Matters When You Invest From UAE

Your income may be in dirhams.

Your retirement might be elsewhere.

Your children’s education could be abroad.

So knowing how to invest in the stock market in UAE means thinking beyond one exchange.

It means building a portfolio that works across borders.

Only after allocation, diversification, and geography are clear should specific investments be selected.

Otherwise, you build excitement, not wealth.

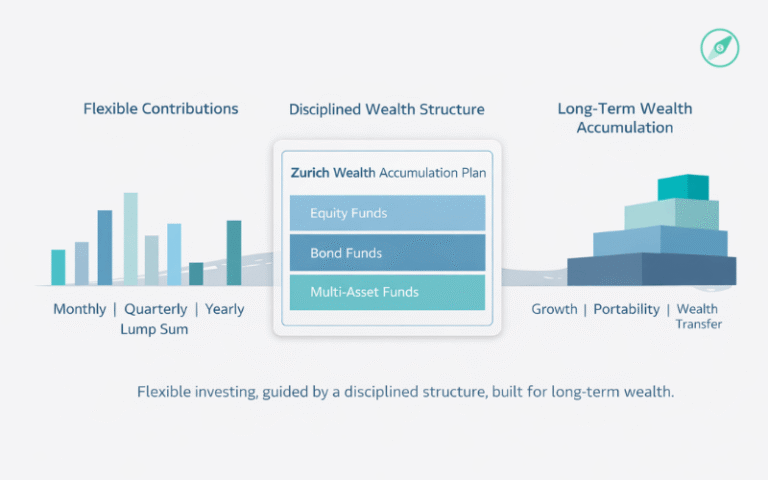

Step 4 – Invest Regularly (This Changes Everything)

Consistency beats brilliance.

Monthly investing helps because:

✔ you buy in good markets

✔ you buy in bad markets

✔ you remove timing stress

✔ you build habit

Most wealth stories are boring.

Same action. Repeated for years.

Step 5 – Track Progress, Not Headlines

Headlines are designed to trigger emotion.

Your job is to track:

• Am I investing regularly?

• Is my allocation right?

• Am I moving toward my target number?

Wealth grows quietly.

Common investing mistakes to Avoid

Here’s where people damage years of effort:

❌ waiting for the perfect entry

❌ stopping investments in bad times

❌ copying friends without a strategy

❌ chasing last year’s winners

❌ investing without emergency funds

❌ mixing trading with long-term planning

Avoid these and you are already ahead of most investors.

When Should You Seek Help?

DIY works when:

✔ goals are simple

✔ amounts are small

✔ emotions are stable

But complexity increases fast in the UAE.

Multiple currencies.

Education abroad.

No pension.

Family responsibilities across countries.

At that point, coordination matters more than product selection.

What a Good Plan Gives You

Clarity on:

• how much you need

• how much to invest

• expected range of outcomes

• risks you must accept

• adjustments required over time

Without this, investing feels like hope.

With this, it becomes strategy.

If You Want to Start — Start Smart

The biggest mistake beginners make is not starting.

The second biggest is starting without structure.

If you want help understanding:

✔ what allocation fits you

✔ how much monthly investing is required

✔ whether you are on track

✔ what to improve

then the next step is a conversation.

👉 Book your discovery call and build a plan that build wealth.