Emergency Fund in UAE: How Much You Need, Where to Keep, & How to Build It?

For most UAE residents and expats, financial stress doesn’t come from poor investments.

It comes the lack of from an Emergency Fund during an adverse financial situation like;

- Job loss

- Medical Emergency

- Family Emergency

- Delayed salaries

- Business slowdown

- Unplanned or sudden relocation

An emergency fund is what separates a temporary setback from a financial disaster.

This guide explains, in practical terms, how an emergency fund in UAE works, how much you really need, where to keep it, and how it fits into a long-term financial plan.

Table of Contents

What Is an Emergency Fund and Why It Matters in the UAE

An emergency fund is liquid money set aside to cover essential living expenses when income stops or reduces unexpectedly.

In the UAE, this is crucial because:

- Employment is not permanent

- Visas are tied to jobs – unless you have a Golden visa

- No Social Security

- Living costs are not manageable without an income

- Healthcare costs can escalate quickly without preparation

An emergency fund is not an investment. It is financial insurance for your lifestyle.

Without it:

- You are forced to sell investments at the wrong time

- Debt becomes the default solution

- You are in financial panic

- Long-term plans get derailed

How Much you need as Emergency savings in UAE?

The right question is not “how much money,” but:

How many months can your household survive without income?

That duration is your financial runway.

The general UAE guideline

- 3 months of income

- Dual-income households

- Stable employment

- Low liabilities

- 6 months income

- Single-income families

- Families with young children or aging parents

- Expats in volatile industries

- Professionals expecting longer job transitions

- 6–9 months (or more)

- Business owners

- Commission-based income

- Households with medical or family obligations abroad

Emergency Fund vs Investing: What Should Come First?

Many people delay building an emergency fund because they fear “missing out” on returns.

This is backward thinking.

Investing without an emergency fund leads to:

- Panic selling during market corrections

- Withdrawing long-term investments prematurely

- Emotional decision-making

A proper emergency fund allows you to:

- Stay invested during volatility

- Add money when markets fall

- Think long-term instead of survival-mode

The correct sequence is:

- Liquid savings

- Growth investments

- Income and long-term wealth strategies

This isn’t conservative.

It’s disciplined.

Emergency Fund vs Debt Payoff: What Should You Prioritize?

This is one of the most common and most misunderstood questions in financial planning.

Many people believe:

“I should clear all my debt before saving anything.”

That sounds smart.

In reality, it’s risky.

Why an emergency fund comes first (even with debt)

If you focus only on debt repayment without any emergency buffer, one unexpected expense can push you right back into debt — often at higher interest rates.

In the UAE, this risk is amplified because:

- Job loss can escalate quickly into visa stress

- Medical or family emergencies may need immediate cash

- Credit cards are often the fastest (and costliest) fallback

An emergency fund prevents debt relapse.

Here is the right sequence

- Stop further borrowing

- Build at least one month’s income as emergency savings

- Choose between Debt Snowball or Avalanche pay off strategies

- Attack debt while parallelly building liquid savings until you reach 3 months income

- Then focus on the debt completely.

Where Should You Keep Your Emergency Savings?

Liquidity is non-negotiable.

Returns are secondary.

Your emergency fund should be accessible within 24–48 hours, without market risk.

Common UAE options

Savings accounts

- Immediate access

- Zero risk

- Keep at least 1–2 months of expenses here

Short-term fixed deposits

- Slightly higher returns

- Ensure premature withdrawal is allowed

National bonds

- Secure

- Reasonably liquid

Gold (limited allocation: 20–25% max)

- Hedge against uncertainty

- Not fully liquid, prices fluctuate

FCNR deposits (for NRIs)

- Currency protection

- Useful if funds may be needed outside the UAE

A blended structure works best:

- Instant access for emergencies

- Modest returns for the remaining buffer

Common Emergency Fund Mistakes UAE Expats Make

This is where most plans quietly fail.

1. Saving too little

One unexpected event wipes out years of progress.

2. Saving too much

Large sums parked in low-return accounts lose value to inflation and slow wealth creation.

3. Investing emergency money

Market volatility and emergencies rarely arrive separately.

4. Mixing emergency funds with goals

Short-term needs should never be mixed with long-term investments.

5. Ignoring lifestyle creep

As income and expenses rise, emergency funds must be recalibrated.

An emergency fund is not “set and forget.”

It evolves with your life.

How to Build an Emergency Fund Step by Step

You don’t need perfection. You need consistency.

Step 1: Set a realistic target

Start with 1 month, then build toward 3–6 months.

Step 2: Automate savings

Treat emergency savings like a fixed obligation, not leftover money.

Step 3: Separate accounts

Emergency money should never sit in your primary spending account.

Step 4: Review annually

Job changes, children, rent increases — all require adjustments.

How Emergency Savings Fits Into a Complete Financial Plan

An emergency fund is Bucket 1: Financial Security.

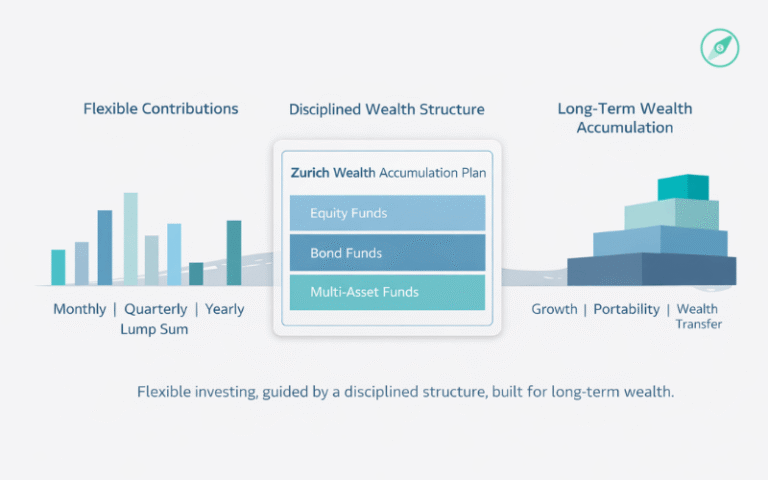

In a structured framework like the GAiM Plan, it works alongside:

- Growth investments (Bucket 2)

- Income and long-term wealth strategies (Bucket 3)

Without Bucket 1:

- Growth becomes fragile

- Income planning becomes stressful

- Long-term goals remain theoretical

With it:

- Decisions are calmer

- Risks are intentional

- Wealth compounds uninterrupted

Final Thought

A pilot doesn’t take off without confirming there’s enough runway to land.

If you’re living and working in the UAE without a proper emergency fund:

- You are exposed, even if income is high

- You are slower than you think

- One disruption can undo years of effort

If you want to know whether your emergency fund is too short, too long, or inefficiently structured, review it in the context of your full financial picture.

👉 Book a short call to assess your emergency fund and overall financial plan