Ardan Wealth Platform | Build, Manage & Transfer Wealth.

Wealth management isn’t about chasing the “best investment.”

It’s about choosing the right structure.

One that supports systematic Wealth accumulation, efficient management, and seamless distribution across borders, currencies, and generations.

Most investors get this part wrong. The Ardan Wealth Platform was built to fix exactly that.

Table of Contents

What Is the Ardan Wealth Platform?

Ardan is a simple, secure, globally connected wealth platform that brings your entire portfolio into one place; clear, flexible, and accessible from anywhere in the world.

It offers:

- Access to 80,000+ global investments

- The ability to hold, view, and trade in 11 major currencies

- No lock‑ins, no exit penalties

- Institutional‑grade custody and asset segregation

- A built‑in Beneficiary Trust for seamless wealth transfer

- Transparent, fully disclosed pricing

- Advisor‑led portfolio management

Ardan is part of IFGL Group, which manages $11 billion in client assets and is trusted by 80,000+ customers across 170 countries. It operates from the Isle of Man, one of the world’s most respected financial jurisdictions.

This is not a product, plan or a policy.

It is wealth infrastructure, designed to support all three stages of wealth: Build, Manage, and Pass On.

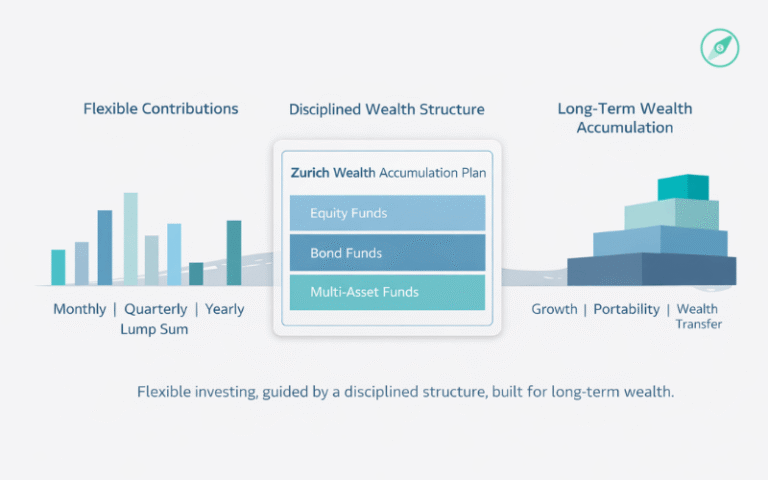

Build: Accumulate Wealth Without Friction

Wealth creation requires discipline, patience, and consistency. What slows people down is friction; rigid plans, limited choices, and outdated structures.

Ardan removes that friction by giving you:

- A global investment universe in one place

- Multi‑currency investing aligned with future goals

- Portfolios built for growth, income, safety and liquidity

Wealth accumulation becomes easier and more intentional when the structure underneath is robust and seamless. Especially when you are building not just for yourself, but also for the generations that follow.

Manage: Flexibility Is the Real Risk Management

Long term Investors rarely lose money because of markets. They lose because their structure limits their ability to adapt.

Ardan is built to preserve flexibility while supporting growth and safety.

Robust Asset Allocation

- Global equities, mutual funds, ETFs

- REITs, dividend funds, bonds, structured notes

- Commodities and alternatives

- Money market funds for liquidity

True Liquidity

- No surrender charges

- No forced holding periods

- Realign assets anytime as life evolves

Multi‑Currency Control

For expats, currency exposure is unavoidable. Ardan lets you hold, switch, and value assets across currencies — essential when income, assets, and liabilities span multiple geographies.

Portability & Tax Awareness

Local products tie you to local systems. Ardan doesn’t.

Its structure is jurisdiction‑agnostic, meaning your wealth remains accessible even if you relocate. And because it avoids artificial tax events, it aligns with international best practices — letting you plan proactively, not defensively.

This is wealth viewed as a global balance sheet, not a country‑specific product.

Safety: Institutional‑Grade Protection

Security isn’t optional.

Ardan operates under the Isle of Man Financial Services Authority (IOMFSA). Client assets are:

- Held via nominee structures

- Fully segregated from Ardan’s own assets

- Custodied with global institutions like Citibank and Allfunds

Even in the unlikely event of platform failure, client assets remain ring‑fenced.

Ardan is independently audited by PwC and is part of International Financial Group Limited (IFGL).

Pass On: Built‑In Beneficiary Trust

Most investors delay succession planning until it becomes urgent and expensive.

Ardan integrates a Beneficiary Trust at no additional cost, allowing you to:

- Nominate trustees and beneficiaries

- Retain full control during your lifetime

- Transfer assets directly to heirs without complex legal challenges and delays.

The trust activates only upon death, ensuring zero interference while you are alive.

This elevates Ardan from an investment platform to a legacy solution.

Why Bespoke, Human Advice Matters

Ardan is advisor‑led because real wealth needs real guidance. Generic, cookie‑cutter solutions can’t account for your goals, your risks, your currencies, or your family’s needs.

Working with an expert, independent financial advisor helps you see the bigger picture and align your investments with it. Your strategy is built around you, not around a preset template.

Transparent Charging Structure

Ardan’s charging structure is intentionally simple and fully transparent. No hidden fees, no surrender penalties, no surprises. Everything is clearly disclosed so you always know exactly what you’re paying for.

Here’s how the costs typically work:

- Platform fee: 0.40% per year, deducted monthly (1/12)

- Set‑up fee: 0–2%, depending on the amount you invest

- Ongoing advisory fee: 1.00% per year, deducted monthly (1/12)

- Dealing and broker costs: starting from $7 per transaction

This clarity ensures your capital works for you, not against you, with every cost aligned to the value you receive.

Ardan Wealth Platform — Who it for and Who It Isn’t

Ardan is for investors who value clarity, flexibility, global access, transparent charges, and advisor‑led guidance.

It’s built for people who want a structure that adapts as their life, income, and location evolve, and for those intentionally building generational wealth

It is not for DIY investors, traders, or anyone looking for standalone investments or guaranteed returns. It’s also not suited for those who prefer to manage everything themselves or who are uncomfortable paying ongoing fees for professional advice and a robust, globally portable structure.

Why Ardan Stands Apart

- Jurisdiction: Isle of Man (Moody’s Aa2)

- Security: Segregated assets, institutional custody, PwC audits

- Flexibility: No lock‑ins, no exit penalties

- Scale: 80,000+ global investments

- Structure: Multi‑currency, advisor‑led, open architecture

- Legacy: Integrated Beneficiary Trust

- Recognition: Multiple “Best International Platform” awards

This isn’t about picking investments. It’s about owning a structure that survives change.

Final Thought: Wealth Is a System, Not a Product

The Ardan Wealth Platform gives you a framework to:

- Build wealth with clarity and consolidation

- Manage it with flexibility, liquidity, and global reach

- Protect it with institutional safeguards

- ensuring your wealth continues to serve your family for generations

If you’re looking for the best investment platform in the UAE or a globally portable wealth management solution, Ardan delivers the structure serious investors rely on.

👉 One well‑structured conversation can change how your wealth behaves for decades.

Book a discovery call, and let’s design a structure that works across markets, borders, and generations.