Retirement Planning for Business Owners in Dubai – UAE

Most business owners in don’t plan to “retire.”

They plan to:

- Step back, not step out

- Reduce operational stress

- Secure their family’s future

- Protect what they have built

- Ensure the business survives without them

- Or exit the business to do something else.

This is why retirement planning for business owners must be fundamentally different from that of salaried professionals.

Business owners live in a different financial reality:

- Income is irregular

- Cashflow is inconsistent

- Risk is concentrated

- Personal and business finances blend together.

- Exit timelines and strategies are unclear or non existent

- Liabilities can spill into personal wealth.

This makes retirement planning for business owners complex and far more essential.

Table of Contents

The Core Risk Most UAE Business Owners Ignore

If you are a business owner or partner in the UAE, your biggest retirement risk is not just poor investment returns or inflation.

It is over-dependence on your business for future income.

This shows up in four ways:

- No separation between business wealth and personal wealth

- No defined exit or succession plan

- No protected income outside the reach of creditors

- No clear post-exit income strategy

A strong business does not automatically equal a strong retirement.

Why “My Business Is My Retirement Plan” Is a Dangerous Assumption

Many business owners believe:

- “The business will take care of me”

- “Nothing gives returns like my business so i don’t need to invest outside my business”

- “Property income will be enough”

- “Markets are risky”

- “Retirement planning is for salaried people”

These beliefs feel logical until things change.

And in business, something always changes.

Reality Check: What Actually Disrupts Business-Led Retirement Plans

1. Business Risk = Concentrated Risk

Your income, reputation, guarantees, and liabilities often sit inside the same structure.

A downturn, dispute, or regulatory issue can hit:

- Business cash flow

- Personal guarantees

- Personal assets

- Family security

2. Personal Guarantees Put Your Retirement at Risk

In the UAE, business loans often require personal guarantees.

If the business struggles or fails to repay, your:

- Savings

- Property

- Investments

can be exposed.

Without separation, your retirement assets are not protected assets.

Succession Planning: By Choice or By Crisis

Every business exits one of three ways:

- Planned succession

- Forced exit

- Value erosion

Without a plan:

And this isn’t just a UAE issue. it’s global. Even Tesla, one of the world’s most valuable companies, faces ongoing pressure from shareholders who want clarity on who would lead the company if Elon Musk were suddenly unavailable. Musk has acknowledged identifying a potential successor, but no name or formal plan has been publicly disclosed, which is why investors continue to raise the issue. (Source : https://www.businessinsider.com)

When a business depends too heavily on one individual, continuity becomes fragile even at the trillion‑dollar level.

For privately held UAE businesses, where personal guarantees, family dynamics, and concentrated ownership add even more complexity, the absence of a succession plan isn’t just a governance gap — it’s a structural vulnerability.

Succession planning is a crucial part of retirement planning for business owners, even if you have no intention of stepping any time soon.

The UAE‑Specific Risk Most Owners Miss: Asset Freezing

In the event of death of a partner or business owner

- Personal and business assets can be frozen

- Access depends on legal structure

- Families may face long delays

This is not theoretical. It happens regularly.

Retirement planning in the UAE is not only about income, it is also about access, continuity, and control

Property Alone Is Not a Retirement Plan

Property is valuable, but it comes with:

- Illiquidity

- Market cycles

- Concentration risk

- Maintenance and vacancy costs

In emergencies, property is slow to convert into cash, and often at the worst possible time.

A retirement strategy must include liquid, portable assets, not just physical ones.

A 4-Pillar Retirement Framework for Business Owners in Dubai – UAE

1. Separation – Personal Wealth vs Business Wealth

Your personal future should not rise and fall solely with your business.

This means:

- Building assets outside the operating company

- Structuring them beyond creditor reach

- Ensuring portability across jurisdictions

Separation creates resilience.

2. The 3‑Layer Protection Model for Business Owners

Layer 1 — Essential Health Protection (Immediate Risk Shield)

This is the foundation. Every business owner needs a strong medical insurance plan that prevents unexpected healthcare costs from draining personal or business cash flow. It ensures that a medical event doesn’t become a financial crisis.

Layer 2 — Critical Illness Liquidity (Income & Stability Protection)

The second layer provides liquidity at the exact moment it’s needed most. A comprehensive critical illness cover delivers a lump‑sum payout on diagnosis or a critical illness. This protects personal income, stabilises the business, and buys time for recovery or transition.

Layer 3 — Business Continuity Protection (Key Person & Partnership Cover)

The top layer protects the business continuity. Key person and partnership insurance ensure the company can survive the permanent loss of a founder or essential partner. It safeguards cash flow, valuation, and operational continuity, preventing a death of the partner / owner from becoming a business‑ending event.

3. Succession – Planned Exit, Not Forced Exit

Succession planning allows:

- Orderly transfer of responsibility

- Protection of business value

- Reduced disruption for partners and family

- Choice over timing and terms

The goal of succession planning is choice. The ability to step back on your terms, not because circumstances force you to. Without structure, decisions happen under urgency, and urgency destroys value.

4. Post-Exit Income Design

Retirement income for business owners should be:

- Predictable

- Diversified

- Liquid

- Independent of daily business operations

This is where most business-led plans fail — and where structured planning adds the most value.

Cross-Border Complexity: The Hidden Risk in Retirement Planning

For globally mobile business owners, retirement planning isn’t just about income or investment, it’s about jurisdictional clarity.

Many UAE entrepreneurs hold:

- Property in multiple countries

- Investments across different tax regimes

- Assets in offshore structures

- Residency or citizenship options

Without coordinated planning, this creates:

- Tax exposure across jurisdictions

- Conflicting inheritance laws

- Frozen assets due to unclear legal structures

- Loss of access during relocation or succession

Tax residency, relocation, and cross-border asset ownership are not side issues, they are central to retirement planning. A well-structured plan must account for:

- Where you are taxed now, and where you might be taxed later

- How your property and investments are treated across borders

- What happens to your assets if you relocate, retire abroad, or pass away

This is where generic retirement advice fails and where bespoke, jurisdiction-aware planning becomes essential.

What Retirement Planning Looks Like in Practice

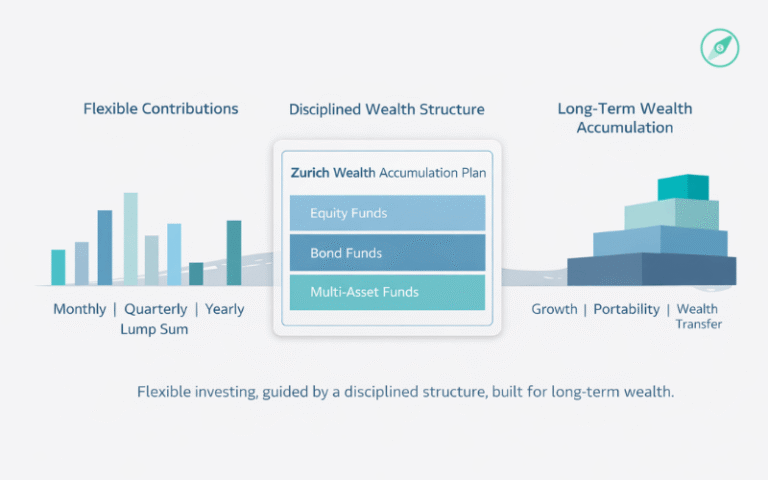

In reality, retirement planning for UAE business owners often includes:

- Internationally portable investment structures

- Multi‑currency diversification

- Clear beneficiary planning

- Liquidity ladders for future income

- Efficient and Adequate medical insurance, Key person and Critical Illness Insurance.

- Cross‑border coordination

These structures evolve as income, risk exposure, and succession timelines change. Entrepreneurs rarely live in straight lines their planning shouldn’t either.

The focus is not on chasing returns. It is on continuity, control, and access.

Why Business Owners Work With Independent Advisors

Business owners do not need product sales.

They need:

- Objective structuring

- Correct sequencing of decisions

- Risk stress-testing

- Long-term coordination across business and personal finances

A good advisor does not replace your judgment, they protect it from blind spots.

Key Takeaways for Business Owners and Partners

- Your business is an asset, not a retirement plan

- Concentration risk is often invisible until it is too late

- Succession without structure destroys value

- Liquidity and access matter more than paper wealth

- Retirement planning is about freedom, not stopping work

Next Step: A Retirement Review for Business Owners

This is not broad retirement advice.

This review is built for business owners who want clarity, structure, and long‑term control — not quick fixes.

It is designed for:

- Business owners and partners in the UAE: People whose personal and business finances are interconnected and need a coordinated plan.

- Founders preparing for succession or a partial exit: Those who want to step back on their terms, not because circumstances force them to.

- Entrepreneurs seeking income security beyond their business: Owners who understand that relying solely on the company is concentration risk, not a retirement plan.

It is not suitable if you are:

- Looking for quick returns: This is about structure and stability, not speculation.

- Comparing products: The focus is on strategy, not shopping.

- Avoiding structural decisions: Real planning requires clarity, separation, and commitment.

Request a Business Owner Retirement Review

A structured, advisor‑led discussion focused on exposure, succession readiness, and post‑business income design.

Not a product pitch, but a strategic conversation about protecting your future.