How to invest in UAE using the 3 Bucket Investment Strategy

If you’re wondering how to invest in UAE, start with a simple question: when will I need the money? or what is my investment horizon.

An investment can work very well for a long-term goal, will be completely wrong for a short-term one. That is why investing is not about finding the “best product or plan” — it’s about putting the right money in the right place for the right amount of time.

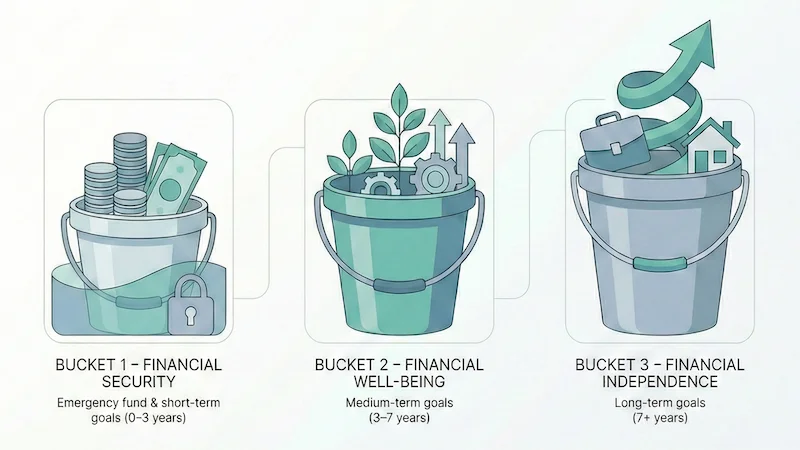

The 3-bucket investment strategy makes this easy to understand and apply.

It separates your money into three buckets based on time horizon: short-term, medium-term, and long-term. Each bucket has a clear role. Bucket 1 keeps you financially secure, Bucket 2 supports planned goals, and Bucket 3 is focused on long-term growth.

With this structure, investing in the UAE becomes more predictable, less stressful, and easier to stay consistent with over time.

Table of Contents

Quick self-check — which of these apply to you?

Tick what’s true right now.

If you ticked even one: the issue isn’t effort or income — it’s structure. A simple bucket plan removes guesswork.

Get clarity with a free discovery callThe 3 Bucket Investment Strategy (Used by Successful Investors)

This framework organises your savings based on time horizon, not excitement, or recent returns FOMO.

Bucket 1: Financial Security

Emergency Fund & Short-Term Goals

Time Horizon: 0–2 years

Purpose: Stability, liquidity, peace of mind

This bucket exists so you never have to:

- Panic during a job loss or income disruption, family or Medical Emergency

- Break long-term investments at the wrong time

- Depend on credit cards or high-interest loans

What belongs here

- Emergency savings (typically 3–6 months of expenses)

- Known short-term goals (vacations, annual expenses, gadgets, planned purchases)

What matters most

Liquidity — not returns.

Money in this bucket should be accessible within 24–48 hours.

Returns here are modest, and that’s intentional.

This bucket isn’t meant to grow wealth, it’s meant to protect everything else.

Think of this bucket as your financial runway.

It gives you the confidence to invest and grow — and the ability to land safely if income stops or life throws a surprise.

How long should that runway be?

Read:

👉 How Long Is Your Financial Runway and Why It Matters

Common mistake

Trying to invest emergency money for higher returns.

This usually backfires, forcing people to sell investments during market stress or take on expensive debt when liquidity is needed most.

👉 Unsure how much liquidity you actually need? Book a free discovery call

Bucket 2: Financial Well‑Being (Medium‑Term Goals)

Time Horizon: 2–7 years

Purpose: Planned growth with controlled risk

Typical goals:

- Property down payment

- Business capital

- Car upgrade

- Major life events

This bucket allows volatility, but not recklessness.

Allocation Guideline

10–30% of surplus income, depending on goal priority and timeline.

What Belongs Here

- Diversified market‑linked investments

- Balanced growth strategies

- Assets that can tolerate short‑term ups and downs

Common Mistake: Chasing high returns for goals that are only a few years away.

👉 Planning a major expense in the next 1–5 years? Book a Free Discovery Call

Bucket 3: Financial Independence

Long‑Term Wealth Creation

Time Horizon: 7+ years

Purpose: Freedom, retirement, education, legacy

This is the most important bucket, and the most neglected.

Ignoring it is why many expats earn well for decades but leave the UAE with income memories instead of capital.

What Belongs Here

- Long‑term growth assets

- Systematic investing strategies

- Retirement and Child education planning

- Income, Life Style Protection & Legacy Planning

Allocation Guideline

50–70% of long‑term investable surplus

Volatility here is not a threat, it’s the engine.

Common Mistake: Stopping investments during market downturns or relying on one asset alone.

👉 Serious about retirement or financial freedom? Book a Free Discovery Call

Why Most People Still Get This Wrong

Even smart professionals struggle because:

- Lifestyle inflation grows faster than investments

- There’s no written plan, only scattered decisions

- Investments are bought before goals are defined

A framework removes emotion. Structure creates confidence.

How I Help

As an independent financial advisor in Dubai, I work with a goal‑first, bucket‑based approach.

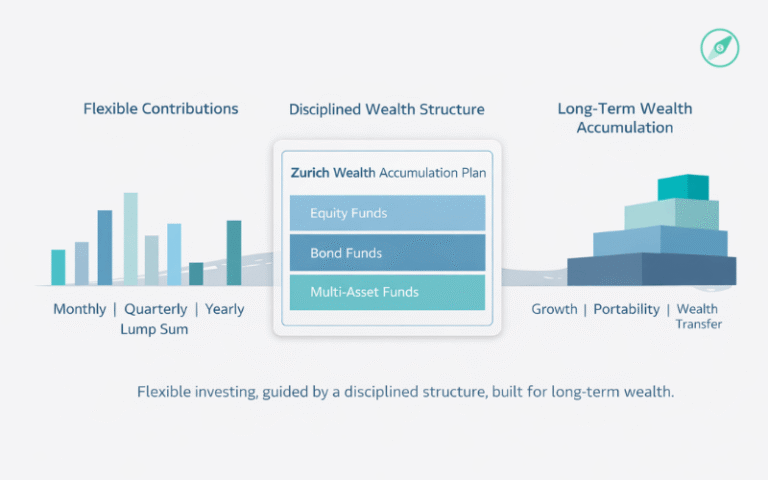

Through a structured GAiM Plan, we:

- Map your goals and timelines

- Align investments to the right bucket

- Implement gradually and review regularly

No guesswork. No product pushing.

Your Next Step

If you want clarity on:

- Which bucket your money belongs to

- How much to allocate where

- How to invest without anxiety or confusion

We’ll assess your situation and see if working together makes sense.