How to Build Wealth From Nothing (A Practical Guide for UAE Expats)

Most people don’t start wealthy, they start with nothing or zero.

Some start below zero, buried under credit cards, student loans, or bad financial habits. Over time, a few build wealth from nothing. Most don’t, and continue living paycheck to paycheck.

Starting at zero is not bad. Stagnation is.

Wealth accumulation is not a one time event; it is a process. It is built by making intentional progress through specific milestones:

$0 → $1,000 → $10,000 → $100,000 → $1,000,000→ $10,000,000+

This guide breaks down a practical, testable system for expats to build wealth from nothing. No gambling, no wishful thinking, no waiting to hit Dubai Duty Free or Big Ticket. A structured plan beats the odds every time.

What “Building Wealth From Nothing” Really Means

Building wealth from nothing means you:

- Don’t have savings

- May have debt

- Live paycheck to paycheck

- Have no investable assets yet

When you are here, wealth-building isn’t about chasing high returns. It’s about building a solid foundation. One that gives you stability, clarity, and the confidence to pursue growth instead of constantly fighting uncertainty.

Here are 10 steps that can help you build wealth from Nothing;

Step 1 — Measure Your Financial Baseline (Don’t Skip This)

You can’t improve what you don’t measure.

You need 2 crucial numbers:

- Net Worth = Assets − Liabilities

- Monthly Investable surplus = Income – Expenses

The investable surplus is your key wealth ingredient and Net worth is your scoreboard.

Avoiding this step because it’s uncomfortable is exactly how people stay broke.

Want to know where you stand – Use this Networth Template.

Step 2 — Build a Zero-BS Budget

To build wealth from nothing, you need a Zero-BS budget.

Don’t think of it as a restrictive tool, it’s about being able to do more with what you already earn.

Income − Needs − Wants = Surplus (Investable Money)

If there’s no surplus, there is no wealth. End of story.

If you don’t know where your money actually goes each month, use the Expat Advantage Budget (EAB). it’s built for UAE expats and helps you identify:

- Needs vs wants

- Hidden leaks

- Lifestyle inflation traps

- Real monthly surplus

👉 Explore the EAB here:

Once you see the numbers clearly, cut expenses with intent:

- Subscriptions

- Frequent dine-outs

- Convenience purchases

- New gadgets

- Unnecessary upgrades

- Lifestyle inflation

People claim they’re “broke” with the latest iPhone and daily delivery food. The numbers either work or they don’t.

Step 3 — Build a Starter Emergency Fund (Your Confidence Engine)

Before investing, build 3 months of essential expenses.

Why?

- Without a buffer, you panic-sell during downturns

- Liquidity = survival

- Confidence = better investing behavior

Your emergency fund isn’t just “rainy day money,” it’s your psychological safety net. The foundation that keeps you calm and rational when life gets noisy.

If you want the full framework, read this article:

👉 How Long Is Your Financial Runway and Why It Matters

It explains why those who have runway make better financial decisions and stick with investments longer.

Keep your emergency savings

- Savings account

- National Bonds

- FCNR Deposits( not all – 50-60% is ok)

Avoid storing it in:

- Stocks

- Crypto

- NFTs

- Any speculative assets

This stage isn’t about returns, it’s about stability, discipline, and confidence.

Step 4 — Raise Your Income (The Wealth Lever Everyone Ignores)

Cutting costs makes you efficient.

Increasing income makes you wealthy.

Income velocity matters more than coupon clipping.

Three income levers:

- Skill upgrades → higher salary

- Career jumps → better pay bands

- Side income → freelance / consulting / service-based

Pick one and execute. Don’t scatter your attention across 7 side hustles.

Step 5 — Eliminate High-Interest Debt

High-interest debt (credit cards, BNPL, personal loans) = wealth cancer.

Pay it off before investing. If your credit card interest rate is 45% PA( yes it is that much or even more) and your expected investment return is 8%, investing first is mathematically stupid.

Two payoff methods:

- Avalanche: highest interest → lowest (optimal math)

- Snowball: smallest balance → largest (optimal psychology)

Use whichever keeps you consistent.

Step 6 — Start Investing With Whatever You Have

The wealthy invest early.

The poor “wait until they have more money.”

Investing doesn’t require wealth — it builds it.

Even $200/month beats waiting for the perfect moment.

Use:

- ETFs

- Index funds

- Income funds

- Global equity funds

Avoid:

- Day trading

- Options

- “Hot picks”

- Leverage

- TikTok finance

Those exist to make someone else rich.

Step 7 — Use a Simple Asset Allocation

Simplicity wins when starting out.

Think in buckets:

Safety + Income + Growth

Example allocation:

- 30% Money Market / Bonds (stability)

- 30% Equity Income (yield)

- 40% Global Equity (growth)

This gives:

- Liquidity

- Stability

- Compounding

The portfolios of self-made wealthy people are boring. That’s the point.

Step 8 — Protect Your Wealth (Insurance Is Non-Negotiable)

One medical event can wipe out a decade of progress.

Protection pillars:

- Health insurance

- Life insurance (if dependents)

- Critical illness cover

- Disability protection

If you earn income and have family but no insurance. You are not brave, you are reckless.

Wealth hates fragility and Protection reduces fragility.

Step 9 — Automate, Reinvest, Compound

CCompounding is often called the eighth wonder of the world — but it isn’t magic. It’s a process with rules.

When followed consistently, it works. When violated, it breaks.

The rules are simple:

- Automate monthly investing

- Reinvest dividends

- Increase contributions over time

- Stay invested through volatility

Compounding doesn’t reward intelligence or predictions. It penalizes behavior.

It punishes:

- Panic sellers

- Market timers

- Get-rich-quick thinkers

- Quitters

There’s no secret formula. Consistency is the cheat code.

Step 10 — Review, Rebalance, Adapt

Every year:

- Check net worth

- Analyze expenses

- Benchmark income

- Adjust allocation

- Update insurance

- Reevaluate goals

Wealth isn’t built by one decision — it’s built by thousands of boring, correct decisions over time.

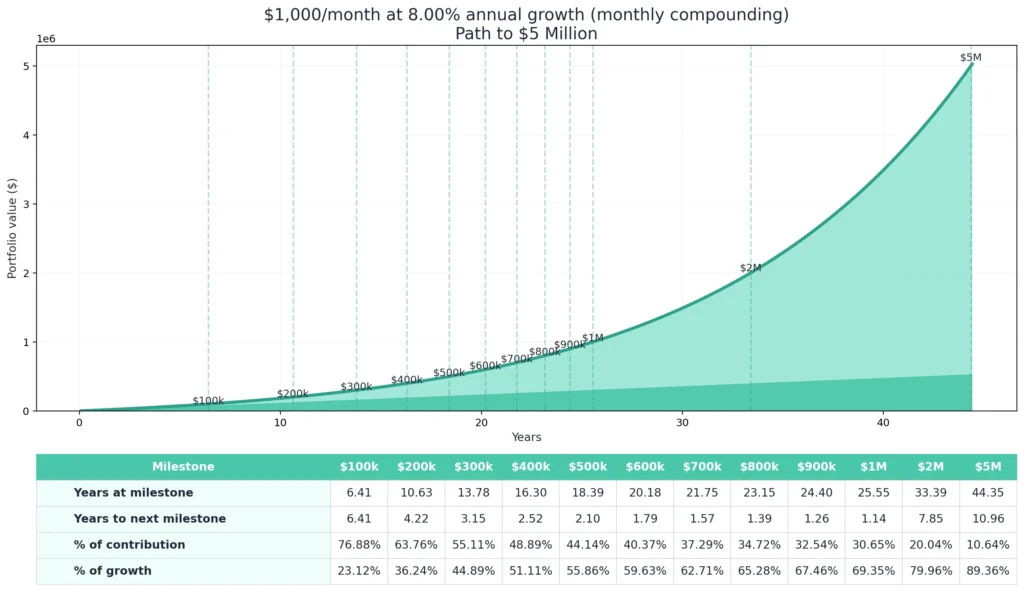

Can You Build Wealth From Nothing in 5–10 Years?

Yes — if you stop lying to yourself.

Example scenario:

- Starting wealth: $0

- Monthly investment: $1,000

- Expected return: 8%

- Duration: 10 years and 6 months

Outcome:

- Total contributed: $126,000

- Ending value: ~$200,000

- Growth: ~$64,000

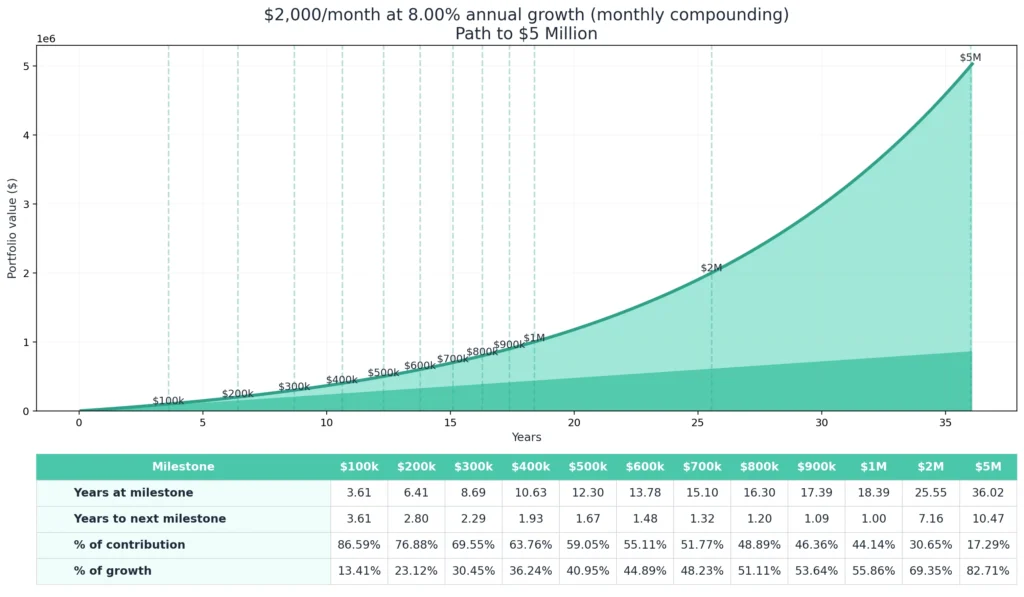

Double the contribution → double the outcome.

Increase income → accelerate everything.

The math works if you do.

FAQs (People Also Ask)

What is the fastest way to build wealth from nothing?

Increase income, eliminate high-interest debt, automate investing, and let compounding do the heavy lifting.

Can I build wealth with a low income?

Yes, but the focus must shift to skill acquisition + income growth while maintaining positive cash flow.

Do I need a financial advisor?

If you want to compress mistakes, build structure, and optimize taxes & protection — yes.

Final Word

Building wealth from nothing is 100% possible, people do it every year.

The formula is not exciting, but it works:

- Measure your starting point

- Control expenses

- Increase income

- Eliminate debt

- Build a runway

- Invest consistently

- Protect the downside

- Let compounding handle the rest

If you’re done chasing shortcuts and ready for structure, here’s the logical next move:

For Serious UAE Expats Who Want Structure, Not Chaos

If you earn well but feel stuck at zero or close to it, I help you build:

- Financial clarity

- Investment strategy

- Risk protection

- Wealth systems

- Generational Wealth planning

No hype. No pressure. Just clarity.

📅 Book a Discovery Call

Start building a system that compounds instead of collapses.

Your future self won’t regret discipline — only delay.