Cost of Living in Dubai (2026): A Practical Guide for Expats

Dubai has a strange dichotomy.

It’s a city where you can earn more, progress faster, and live safer than almost anywhere on the planet and yet many residents feel financially stuck.

Higher income, better lifestyle, bigger opportunities, then why do many expats leave after 5–10 years with great memories but very little wealth.

This post gives you:

- the real average cost of living in Dubai

- what salary you actually need

- the behavioral traps that drain wealth here

- and how to fix them before they compound

Whether you already live here or you’re planning the move, read this before you start budgeting on assumptions.

Average Cost of Living in Dubai (2026 Overview)

People argue about whether Dubai is “expensive,” but the reality is simpler:

Dubai is as expensive as the lifestyle you choose.

Here’s a realistic monthly cost breakdown for 2026:

| Category | Single | Couple | Family (4) |

|---|---|---|---|

| Rent | AED 4,000–8,000 | AED 6,500–12,000 | AED 10,000–20,000+ |

| Utilities | AED 300–1,000 | AED 800–1,200 | AED 900–2,000 |

| Groceries | AED 800–1,500 | AED 1,200–2,500 | AED 2,500–4,500 |

| Transport | AED 300–1,500 | AED 500–2,000 | AED 1,200–2,500 |

| Schooling | — | — | AED 1,600–6,000+ / child |

| Eating Out + Lifestyle | AED 800–2,500 | AED 1,500–3,500 | AED 2,500–6,000 |

| Maid / Cleaner / Domestic Help | AED 400 | AED 600–2,200 | AED 900–2,200 |

| Miscellaneous | AED 1,000 | AED 2,000 | AED 3,000 |

| Vacations (Annual ÷ 12) | AED 500–1,000 | AED 1,000–2,000 | AED 2,000–5,000+ |

Estimated total monthly cost (excluding health insurance):

- Single: AED 8,100 – 16,900

- Couple: AED 14,100 – 27,400

- Family of 4: AED 26,200 – 57,200+ ( including schooling for 2 children)

Health Insurance Note:

Health insurance is typically provided by employers in Dubai.

If insurance is not provided (or dependents are not covered), expect additional monthly costs.

Typical ranges if self-funded:

- Single: AED 300–600/month

- Couple: AED 600–1,500/month

- Family: AED 1,200–3,000/month

What Salary Do You Need to Live Comfortably in Dubai?

Based on the above ranges, a comfortable (not luxury) lifestyle generally requires:

- Single: AED 12,000–18,000/month

- Couple: AED 20,000–30,000/month

- Family of 4: AED 35,000–60,000/month

Here’s the twist:

Two families earning AED 50,000/month can end up in two completely different financial realities.

Why? Because cost of living is one factor and the behavior is the multiplier.

Why High Earners Still Feel Broke in Dubai

The biggest financial drain in Dubai isn’t rent or school fees or the brunches — it’s psychology.

Here are the most common traps:

1. Lifestyle Benchmarking

Dubai makes lifestyle upgrades feel normal:

- better communities,

- better cars,

- better schools,

- better holidays.

The benchmark quietly rises — income rises, lifestyle rises, surplus stays flat.

2. No Surplus Awareness

Ask most expats:

“How much investable surplus do you generate monthly?”

Blank stare.

If you don’t know your surplus, you don’t know your trajectory.

3. Delayed Investing

People “wait for stability.” Stability is a myth. Compounding rewards time, not perfection.

Before You Invest: You Need Surplus Clarity

Most expats don’t fail because of low income — they fail because they focus on making ends meet instead of budgeting to generate an investable surplus.

Surplus is the fuel for investing.

No surplus → no compounding → no wealth acceleration.

If you don’t know your investable surplus, you’re not thriving — you’re just surviving, and wasting the Dubai advantage.

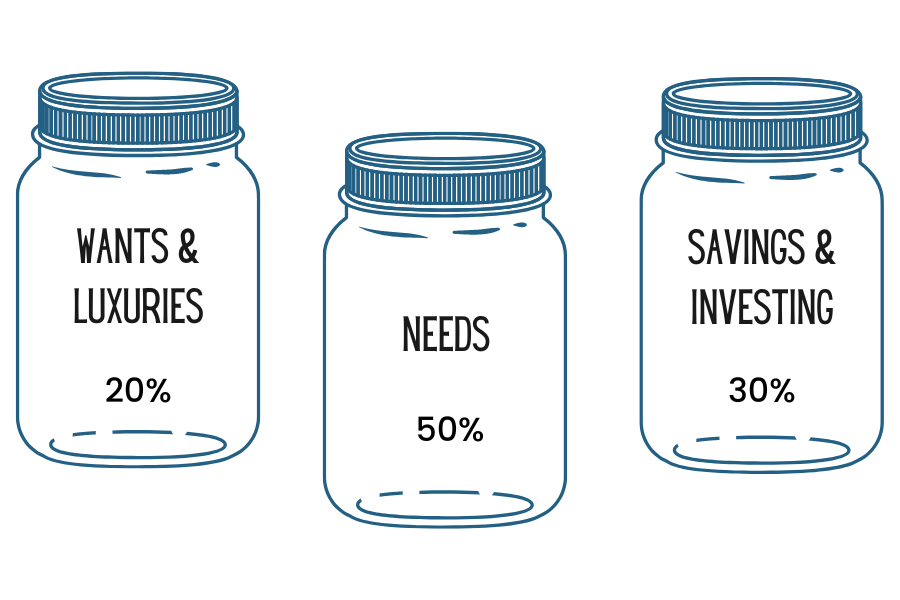

That’s why many people default to simple budgeting rules like 50/30/20 . It’s familiar, structured, and easy to follow. It works great for maintaining stability.

But here’s the problem: expats don’t move to Dubai for stability — they move for progress.

The 50/30/20 rule is excellent for maintenance.

The Expat Advantage Budget is designed for acceleration.

You moved abroad to get ahead.

Make sure your budget reflects that ambition.

📥 Expat Advantage Budget (EAB) — Budgeting Tool for UAE Residents

Most budgeting tools are built for the US or EU. They assume taxes, mortgages, and insurance mandates that don’t apply here.

The Expat Advantage Budget (EAB) is built for the UAE’s reality.

In 15 minutes, it shows:

- where your money goes

- how much surplus you actually have

- where lifestyle creep is hiding

- how much you can invest safely

- how big your emergency buffer should be

This is the baseline you need before thinking about investing, real estate, or retirement.

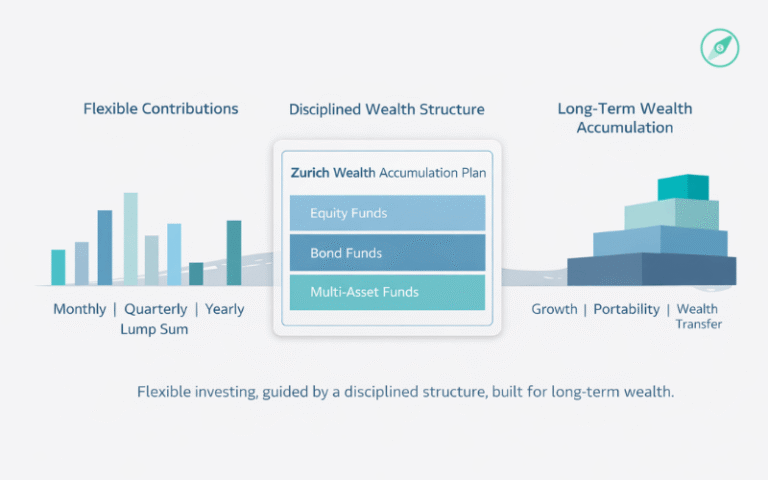

Turning Dubai Into a Wealth Accelerator

Once surplus is clear, you can finally make Dubai work for you.

The formula is simple:

- Earn in a low-tax environment

- Avoid lifestyle drag

- Invest early (preferably USD/global assets)

- Protect against loss of income

- Let compounding do the heavy lifting

Here are tools to model that:

➤ SIP Calculator (UAE Version)

Model compounding over time:

➡ SIP Calculator UAE

➤ Inflation Calculator

See how much inflation silently erodes purchasing power:

➡ https://www.financialplanningindubai.com/inflation-calculator-uae

➤ Rent vs Buy Calculator

Avoid emotional real estate decisions — run the numbers first:

➡ How much house can I buy?

Together, these tools give you clarity, not guesswork.

Final Takeaway

The “cost of living in Dubai” isn’t the true financial risk.

The true risk is:

- lifestyle benchmarking,

- lack of surplus awareness,

- delayed investing,

- and currency blind spots.

Dubai can be a wealth accelerator or a lifestyle treadmill. Same city. Different results.

The variable is not Dubai — it’s your system.

If You Want a Smarter Financial System — Not Just More Information

You’re one conversation away from:

✔ knowing exactly where you stand,

✔ aligning your financial goals with reality,

✔ building a structured wealth plan,

✔ and using Dubai to your advantage.

📞 Book a 15-Minute Discovery Call

No jargon. No pressure. Just clarity.

➡ https://www.financialplanningindubai.com/meetings/damodhar