Why the 50/30/20 Rule is a Trap for Expats, & What to Use Instead?

If you have ever Googled “how to budget,” you have almost certainly found the 50/30/20 rule. It is the most famous budgeting rule in the world for a reason: it is simple, it is balanced, and it works for the average person.

But as an expat, you are not the “average person.”

You likely moved into the UAE for an opportunity, a higher salary, tax-free income, or faster career growth. Relying on a standard 50 30 20 budget designed for a stable, home-country life might actually be slowing you down.

If you are specifically looking for a budgeting rule for UAE expats, the standard advice needs an upgrade.

Why the 50/30/20 Rule Falls Short for Expats

To understand why this rule needs an update, we have to look at where it came from. The 50/30/20 budget rule was created and popularized by U.S. Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi. They introduced the concept in their 2005 book, All Your Worth: The Ultimate Lifetime Money Plan.

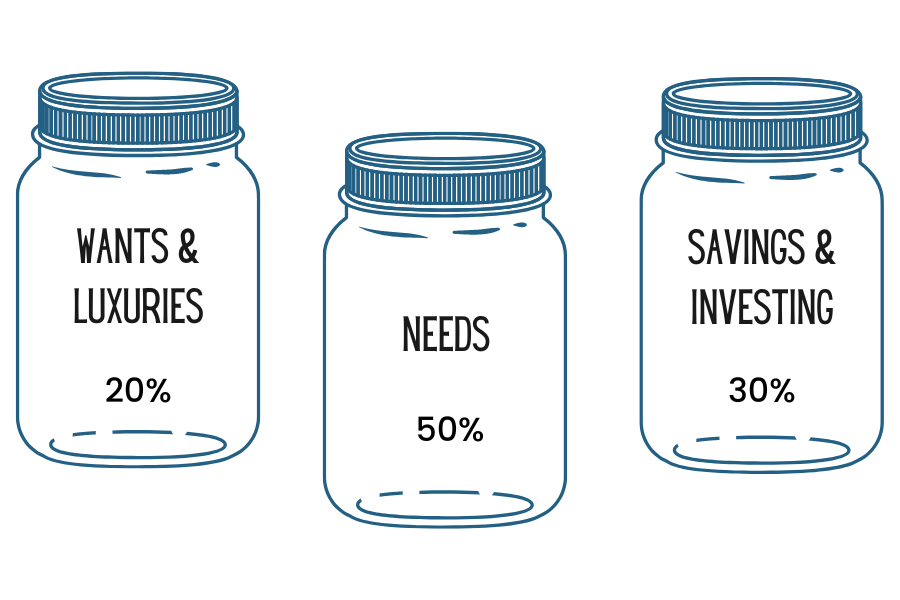

It was a revolutionary framework for the average American household facing bankruptcy and debt. The rule breaks income down like this:

- 50% Needs: Rent, groceries, bills.

- 30% Wants: Travel, dining, fun.

- 20% Savings: Future you.

This ratio is fantastic for stability. However, it assumes you have a 30-40 year career in your home country to save for retirement. Expats often don’t have that luxury. We have compressed earning windows. We are here to make hay while the sun shines.

If you are earning a tax-free salary but only saving 20% because a rule from 2005 told you to, you are leaving your “Expat Advantage” on the table.

The Upgrade: The Expat Advantage Budget (50/20/30)

The Expat Advantage Budget runs on a more aggressive, wealth-focused formula: 50/20/30.

It tweaks the classic 50 30 20 rule by flipping the “Wants” and “Savings” buckets.

- 50% Needs: Keep your lifestyle anchors (rent, school fees) stable.

- 20% Wants: Enjoy your life abroad, but trim the excess.

- 30% Savings: This is your Advantage.

The Behavioral Shift: From “Spending” to “Keep Rate”

Behavioral finance tells us that humans are prone to lifestyle creep. When we move to a city like Dubai or Singapore, our “Wants” naturally inflate to match our peers.

The EAB model forces a “pay yourself first” mentality that is 50% stronger than the average advice.

- Standard Rule: Saves 20% (Good).

- EAB Rule: Saves 30% (Exceptional).

By shifting just 10% from “Wants” to “Savings,” you aren’t restricting your life; you are buying your freedom date sooner.

50/30/20 vs. 50/20/30: The Math of the Advantage

Let’s look at the numbers. Assume you earn AED 30,000 a month.

| Category | Standard (50/30/20) | Expat Advantage Budget (50/20/30) | The Difference |

| Needs (50%) | AED 15,000 | AED 15,000 | Same foundation. |

| Wants (30% vs 20%) | AED 9,000 | AED 6,000 | Still AED 6,000 for fun! |

| Savings (20% vs 30%) | AED 6,000 | AED 9,000 | +AED 3,000/month invested |

Here is the “Aha!” moment: Under the EAB model, you still have AED 6,000 a month just for fun. That is plenty for brunches, dinners, and weekend trips. You aren’t suffering.

But that extra AED 3,000 a month in savings? If invested at an average 7% return over a 10-year expat stint, that difference grows to over AED 500,000 in extra wealth.

The question is: Is spending that extra 3k on random “stuff” this month worth sacrificing half a million dirhams in your future?

How to Apply the Expat Advantage Budget Efficiently

If you are ready to graduate from the basic 50 30 20 budget to the high-performance EAB model, here is how to do it efficiently:

- Reframe “Wants”: Don’t view the drop from 30% to 20% as a loss. View it as filtering out the spending that doesn’t actually make you happy (mindless subscriptions, convenience fees) so you can focus on the high-value fun.

- Automate the Advantage: The moment your salary hits, that 30% (AED 9,000) must leave your account. If it sits there, you will spend it (Parkinson’s Law).

- Protect the 50%: The biggest threat to any budget is rent. Ensure your housing costs fit strictly within the 50% Needs bucket.

The Bottom Line

The 50/30/20 rule is excellent for maintenance. The Expat Advantage Budget is designed for acceleration.

You moved abroad to get ahead. Make sure your budget reflects that ambition.

“Ready to flip the script? Get the System.

Don’t just read about wealth—automate it. We’ve built a plug-and-play EAB Spreadsheet that automatically calculates your 50/20/30 split and helps you track your ‘Keep Rate.’ Stop guessing and start building your advantage today.

Download the Free EAB Template